Th e bond is best described as a. The coupon rate ranges between 3 and 6.

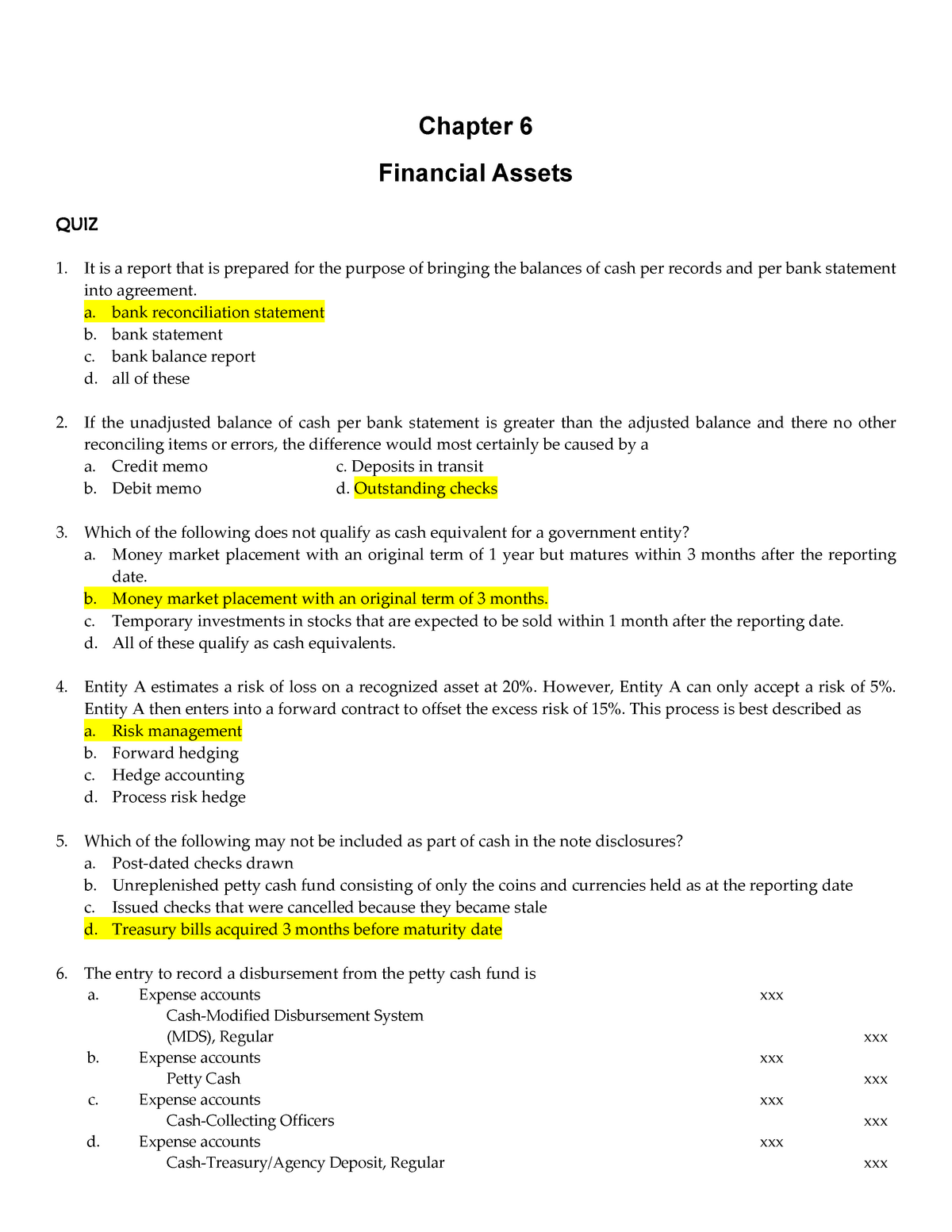

Final 21 December 2018 Questions And Answers Chapter 6 Financial Assets Quiz It Is A Report That Studocu

Such issues may include.

. These bonds are known as quasi-government bonds or agency bonds. Quasi-government bonds are rated very highly due to their. The IRS Tax Exempt Government Entities division continues to focus on private inurement as a strategic issue area and the possibility of private inurement in a quasi-governmental entity will immediately raise red flags and potentially disqualify an organization that otherwise meets the statutory requirements of Sec.

Local governments quasi-government entities and supranational agencies issue bonds which are named non-sovereign quasi-government and supranational bonds respectively. This observation remains resolved. Also known as payroll taxes government entities must withhold federal income tax from employees wages.

Purchases 530000 465000 COGS squeeze 215000 end. Supranational bonds are bonds issued by supranational agencies such as the World Bank. B quasi- government bond C non- sovereign government bond.

A company has issued a fl oating-rate note with a coupon rate equal to the three-month Libor 65 basis points. Risks Associated with investing. The bond issuer agrees to pay its investors periodic fixed interest payments hence the name fixed income while the loan is outstanding and to pay back the full loan at the end of the.

Sovereign bonds are debt securities issued by a government to raise capital for spending needs such as on government programs and paying down debt. Their credit ratings are very high due to extremely low historical default rates. Bonds issued by local governments.

Take note that KrisEnergy is a zero coupon bond. C quasi- government bond. Within the quasi government a category of entities can be collectively identified as congressionally chartered nonprofit organizations also referred to popularly as title 36 corporations 84 The chartering by Congress of private organizations with a patriotic charitable historical or educational purpose is essentially a 20 th century practice.

Federal tax obligations. Some examples are Fannie Mae Federal Mortgage Association Freddie Mac in the US and Hydro-Quebec in Canada. A bond issued by a local government authority typically without an explicit funding commitment from the national government is most likely classified as a.

5 Finalize Capital Projects Lists Timely The audit report indicated that Treasury had not finalized the capital projects list supporting its November 2012 bond issue as of March 5 2014. They are referred to as quasi-government entities although they take different names in different countries. The IMF is a multilateral agency that issues supranational bonds.

The value of your investment may fall as well as rise and you may get back less than you originally invested. 160000 10000 Purchase Disc. National governments establish quasi-government organizations which have both public and private sector characteristics.

These entities issue quasi-government bonds or agency bonds. Two other types of nonprofit corporations are eligible to use tax-exempt bonds. Entity A a government entity and a manufacturer of military equipment had inventories at the beginning and end of its current year as follows.

Operations Management questions and answers. State and local government entities may be covered by Section 218 agreements that. There were nearly 100.

Judicial approval before the bonds are issued. Agency bonds are issued by Local governments none of the answers listed here National governments Quasi-government entities 2- The distinction between capital market instruments and money market instruments is best described as differences. 44Which of the following is a difference between an ontherun and.

Examples of quasi-government entities include government-sponsored enterprises GSEs. The type of bond issued by a multilateral agency such as the International Monetary Fund IMF is best described as a. There is a class of issuers in Indian debt markets that is treated as being very safe in terms of credit risk the quasi-sovereign companies.

Agency bonds are issued by. Interest payments are made quarterly on 31 March 30 June 30 September and 31. For example in the table above buying one lot of Astrea IV 6AZB bonds would cost 1026 1000 1026.

Most of them are not secured by collateral and dont have government guarantees. Secured obligations of a national government. A sovereign bond.

If a bond transaction is controversial and gives rise to a reverse validation action the issuer will find itself a party to that litigation. One exception a 63-20 corporation that can itself issue tax-exempt bonds is described below in footnote 4. Quasi-government bonds are issued by the government through various political subdivisions.

A sovereign bond has a maturity of 15 years. Companies raise debt in the form of bilateral loans syndicated loans commercial paper notes and bonds. Bonds are basically loans.

Government entities may be required to withhold social security and Medicare taxes from employees wages and pay a matching amount. You can view the latest on SGX here. Entity As cost of sales is a.

The type of bond issued by a multilateral agency such as the International Monetary Fund IMF is best described as a. The Fund aims to provide an exposure to the performance of bonds issued by the governments or quasi-government entities of emerging markets countries globally which are denominated in US Dollars. Sovereign bonds can be issued in the government.

Liabilities and in particular information on bonds and loans issued with State guarantees. A company state or government issues bonds to raise money to fund expansion programs or build schools and hospitals. Furthermore after the bonds are issued the issuer will be ultimately responsible for long-term management and troubleshooting.

19 An organization. Sovereign bonds are best described as. 43Bonds issued by the International Monetary Fund IMF are most accurately described as.

21 The type of bond issued by a multilateral agency such as the International Monetary Fund IMF is best described as a. Refer to Board Lot to determine the minimum lot size of each retail bond. Generally these include the so.

1 an instrumen-tality of a governmental entity as described in IRS Revenue Ruling 57-128 which involves a good deal. 22 A bond issued by a local government authority typically without an explicit funding commitment from the national government is most likely classified as a. The difference between the yield on a non-government bond and the government bond yield or LIBOR rate is known as the credit spread For example a company with a slightly lower credit rating than its government might issue a bond with a yield or credit spread of 50 basis points 05 over a government bond with the same maturity.

These quasi-government entities often issue bonds to fund specific financing needs.

What Are The Risks Of Bonds Types Of Risks Of Bonds Brooks Macdonald

The Quasi Government Hybrid Organizations With Both Government And Private Sector Legal Characteristics Everycrsreport Com

Esg Integration In Sub Sovereign Debt The Us Municipal Bond Market Discussion Paper Pri

What Are Quasi Government Bonds The Finanalyst

Quasi Official Agencies Roles Purposes Video Lesson Transcript Study Com

/GettyImages-1018059526-ab2c0ee822c74297a255c21faf038a89.jpg)

0 Comments